linked to the intrinsic objectives and design of a financial contract (e.g.In turn the degree of (un)certainty can be categorized as (The certainty here refers to what is stipulated in the defining term-sheet, not any Risk Factor associated with the future realization of cash flows.). form the basis for accounting treatment under IFRS 9 (via the SPPI test)Ĭontractual cash flows are specified in some form in almost all economic contracts, hence there is a enormous variety.form the Legal Basis for establishing a Credit Event (when the scheduled transfers do not occur).

#Cash flow finance definition plus

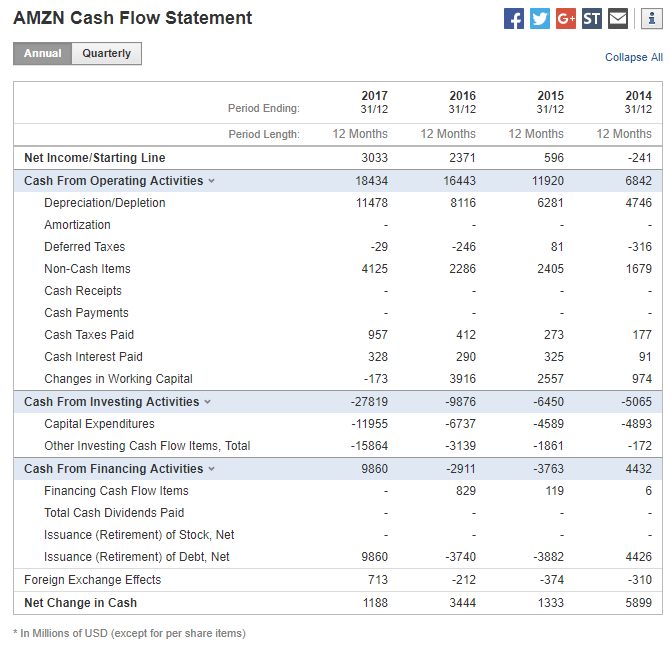

Operating cash flow, calculated as cash flow (the sum of net income and noncash expenses such as depreciation, depletion, and amortization) plus interest expense plus income tax expense, is an important consideration in corporate acquisitions because it indicates the cash flow that is available to service a firm's debt.

Thus, although TCI reported an additional loss, the quarter was generally considered quite successful. It also reported a 5% increase in cash flow. At the same time, the firm added more than a million new customers and reported a 25% increase in revenues. In early 1996, TCI Communications, at the time the nation's largest cable operator, reported fourth-quarter results that included a net loss of $70 million, more than double the loss reported in the year-earlier quarter. Cable companies have huge investment requirements and are typical of firms that may be quite healthy in spite of reporting net losses. A firm with large amounts of new investments and corresponding high depreciation charges might report low or negative earnings at the same time it has large cash flows to service debt and to acquire additional assets. Reduced income generally means lower taxes and more cash, thus the same accounting practices that reduce net income can actually increase cash flow. On the other hand, reported net income is heavily influenced by a firm's accounting practices. Increased cash flow means more funds are available to pay dividends, service or reduce debt, and invest in new assets. Case Study Financial analysts generally consider cash flow to be the best measure of a company's financial health.

0 kommentar(er)

0 kommentar(er)